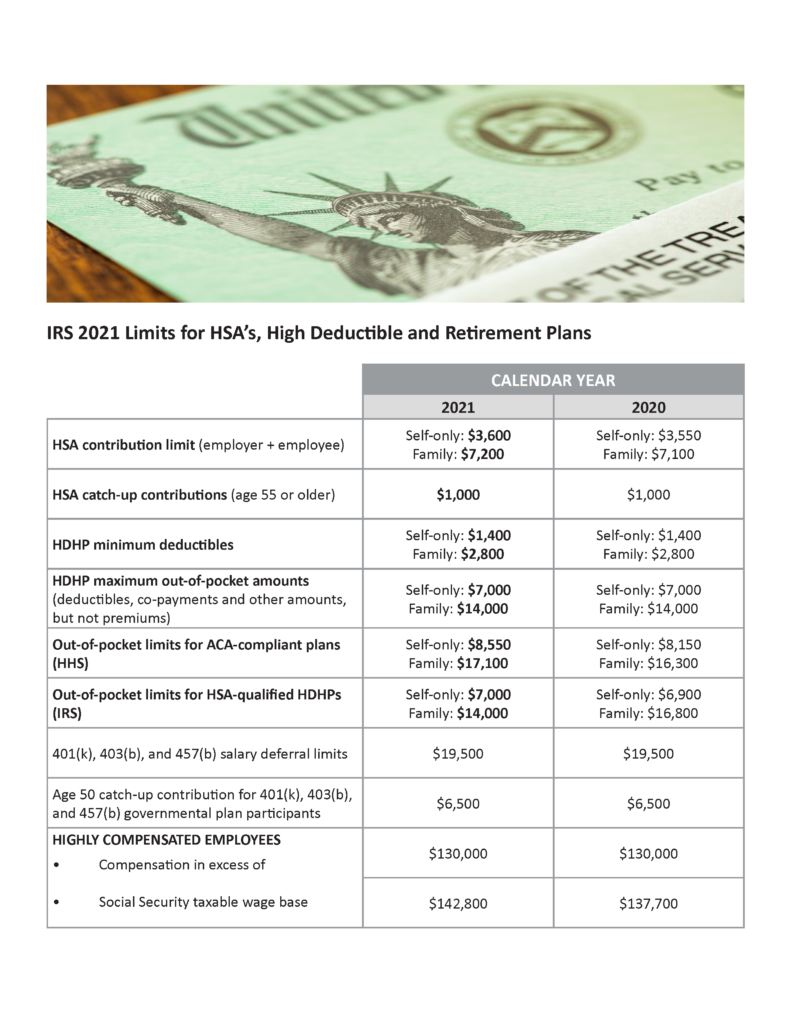

The annual limits for Health Savings Account (HSA) contributions in 2021 will be $3,600 for self-only coverage and $7,200 for family coverage. This represents a $50 increase for self-only coverage and $100 increase for family coverage. The 2021 retirement plan deferral limits will remain the at the same level with a $19,500 annual deferral limit and a $6,500 catch-up contribution level.

The chart below outlines the IRS HSA, ACA & Retirement plan limits for 2021, with applicable increases over 2020.

For further questions, please contact a FosterThomas advisor today: