Updated Deadlines

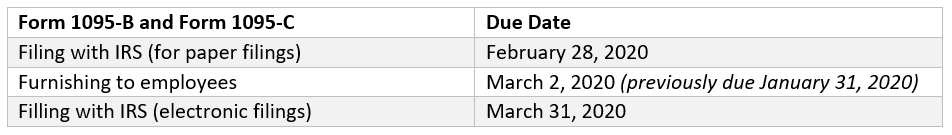

The IRS has issued Notice 2019-63 extending the distribution deadline of Form 1095-B (Health Coverage) and Form 1095-C (Employer-Provided Health Insurance Offer and Coverage) to employees from January 31, 2020 to March 2, 2020.

It is important to note that the deadlines are not extended for filing Forms with the IRS. The deadlines are detailed below.

Who does this apply to?

This extension applies to employers who administer self-funded insurance and will affect Applicable Large Employers (ALEs) and their reporting obligations under the ACA’s Employer Mandate. For smaller organizations,

Good-Faith Relief

A penalty will not be imposed for failure to furnish Form 1095-C to any employee enrolled in an ALE member’s self-insured health plan who is not a full-time employee in 2019 if certain conditions are met.

In addition, a penalty will not be incurred for failure to file Form 1095-C or furnish Form 1095-C to employees as long as a good faith effort is made to comply with the information reporting requirements.