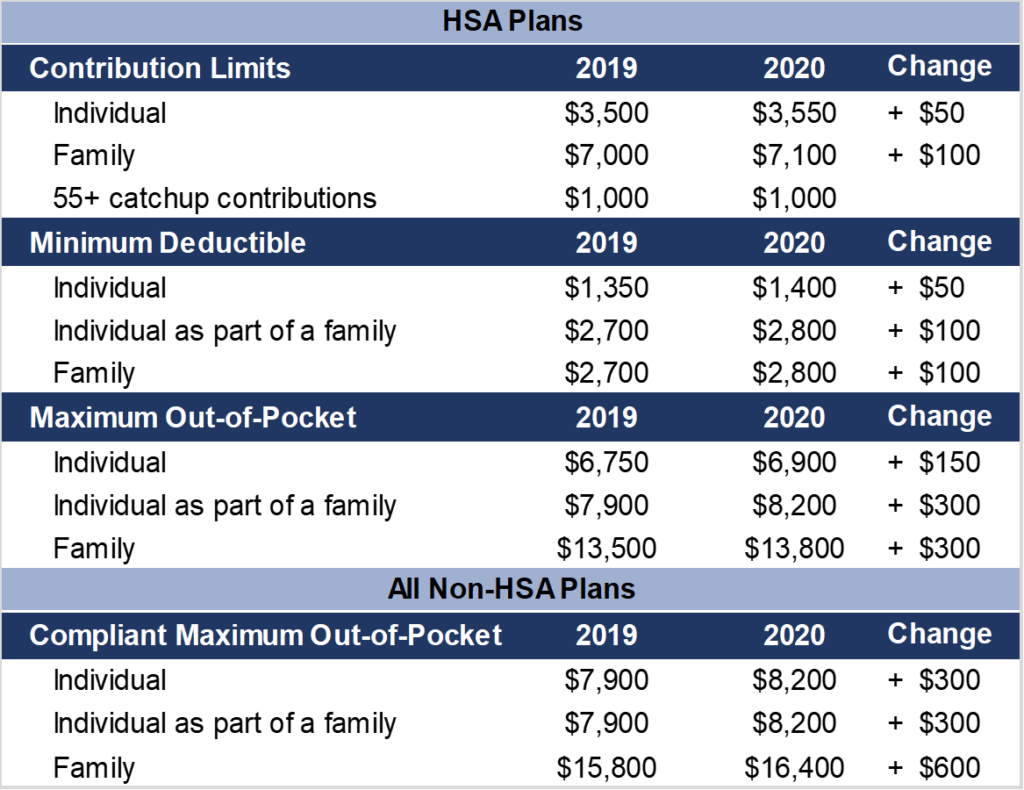

The IRS has announced the annual Health Savings Account (HSA) contribution limits and High Deductible Health Plan (HDHP) minimum deductible and maximum out-of-pocket limits that will apply in 2020.

- Individual contributions are increasing from $3,500 to $3,550.

- Maximum contributions for family plans are increasing from $7,000 to $7,100.

- High deductible plans in 2020 will be those that have an annual deductible are increasing to $1,400 for self-only coverage and $2,800 for family coverage.

- The annual catch-up contribution of $1,000 for account holders that are 55 or older is unchanged.

- Out of pocket maximums are increasing to $6,900 for individuals and $13,800 for families.

2019 vs. 2020 HSA Contribution Limits

It is important that employers pay careful notice to these changes if you offer group health coverage. If you are unsure if your health plan is compliant, please contact an Employee Benefits Expert at FosterThomas HR. Let’s Talk.