The following information is provided as guidance for employers and their employees regarding Medicare Part D notification requirements. Should you have specific questions regarding your organization’s health plan, or other employee benefits, please contact a FosterThomas Employee Benefits Specialist.

Medicare Part D Eligible Employees

This post serves as a reminder that employers who provide prescription drug benefit plans must notify Medicare eligible employees, no later than October 15th, each calendar year, as to whether their prescription drug benefit falls under creditable coverage or non-creditable coverage.

Medicare Part D applies to those that are covered under or apply for an employer’s prescription drug benefits plan.

ATTENTION EMPLOYERS: Which Employees Must be Notified?

If you are a Medicare Part D plan sponsor, you must review and tailor applicable notifications to make sure they reflect the provisions of your prescription drug benefit plan. Employers must also notify the Centers for Medicare & Medicaid Services (CMS) as to whether the employer health plan is creditable. This notification must also occur each year.

The notice must be provided to the following:

- Medicare beneficiaries who are active employees (and their dependents)

- Medicare beneficiaries who are retired (and their dependents)

- Medicare beneficiaries who are covered as spouses under active or retiree coverage (dependents)

- Medicare eligible COBRA individuals and their dependents

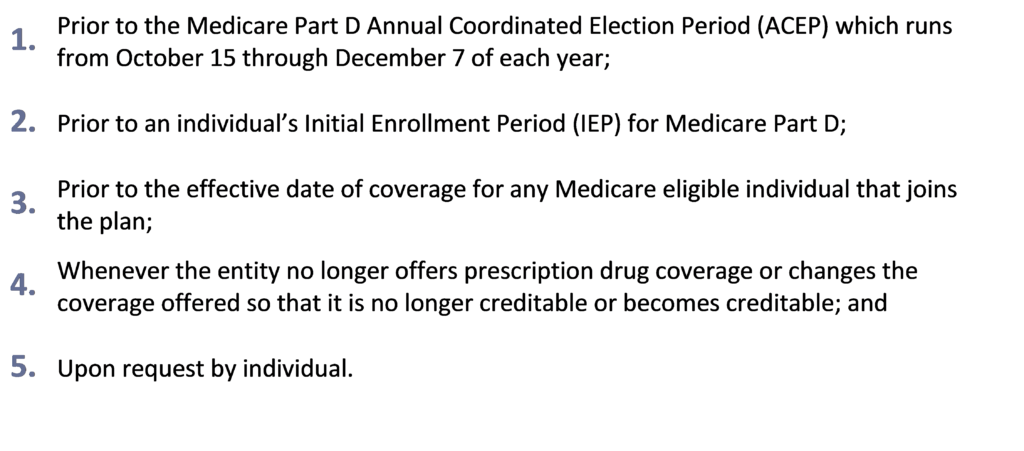

Additionally, disclosures to individuals must be made:

If the creditable coverage disclosure notice is provided to all plan participants annually, prior to October 15 of each year, CMS will consider items 1 and 2 above to be met.

METHOD OF DELIVERY

Employers can provide participants with separate notices, or, under certain conditions, can provide the notice with enrollment materials or summary plan descriptions (SPDs).

NOTIFICATION TO CMS

Employers must also notify CMS (CMS Creditable Coverage Disclosure User Manual) as to the creditable coverage status of the group health plan for prescription drug coverage. The following deadlines for notification are as follows:

- Change in the Creditable Coverage Status: Within 30 days after any change in the creditable coverage status

- Termination of a Drug Plan: Within 30 days after the termination of the prescription drug plan

- Beginning of a Plan Year: Within 60 days after the beginning date of the plan year

HR COMPLIANCE AND WHY THIS MATTERS: Participant Disclosure Model Notices/Sample Notification Letters

The CMS has provided Model Notice Disclosures for creditable and non-creditable coverage. These Model Notice Letters will help employers adhere to compliance, while properly notifying plan participants. These Model Notices are also available in Spanish. Additionally, these Model Notices may be modified in order to notify applicable plan participants. These Model Notices can be found by clicking the button below:

Sample Notification Letters from CMS

METHOD OF NOTIFICATION TO PLAN PARTICIPANTS, BENEFICIARIES AND DEPENDENTS

- Regular USPS mail is the preferred and recommended method of notification/delivery; however, it is important to verify terms of notification in an individual employee’s personnel records.

- Email/Electronic notification is also an option, but must be in accordance with the DOL electronic delivery requirements. It is a good idea to send out a hard copy of the notification via USPS, and follow up with an electronic/email notification to the plan participant. As an employer you must stress that the participant is responsible to provide a copy to their Medicare eligible dependents who may be covered under the health plan.

- Website notification – In addition to the above methods, the employer must also post the disclosure notice on the company intranet or employee accessible area of the website. It is also recommended that the link to the creditable coverage notice is also made available.

- COBRA qualified beneficiaries – It is important to note that this group of beneficiaries may no longer have access to the company website. In this instance certified USPS mail, is the recommended method of notification.

Remember, the model notices are available on the CMS website (see the Model Notices/Sample Letters link above) and may be modified to fit the needs/personalization of your organization. If you are unclear as to how to do this, please contact a FosterThomas Employee Benefits Specialist for assistance.

EMPLOYEE BENEFITS GUIDANCE FROM FOSTERTHOMAS

Need assistance with your Medicare Part D 2019 Notice? Contact a FosterThomas Employee Benefits Specialist for guidance!